On April 23 Finance Latvia, European Commission and Nasdaq Nordic in partnership with Free Trade Union Confederation of Latvia and Estonian Banking Association organized industry event to foster action focused dialogue between industry and public sector experts regarding PEPP in the EU and its impact on capital markets and sustainable pensions income in the Nordic-Baltic region.

Welcome to see the short summary of industry event: “Impact of PEPP on EU Capital Markets and Sustainable Pensions Income” (in English).

Key highlights from:

The event was opened by Egils Baldzēns, President, Free Trade Union Confederation of Latvia (LBAS) (in Latvian).

—

The keynote speech was delivered by Valdis Dombrovskis, Vice-President for the Euro and Social Dialogue, also in charge of Financial Stability, Financial Services, and Capital Markets Union, European Commission (in English).

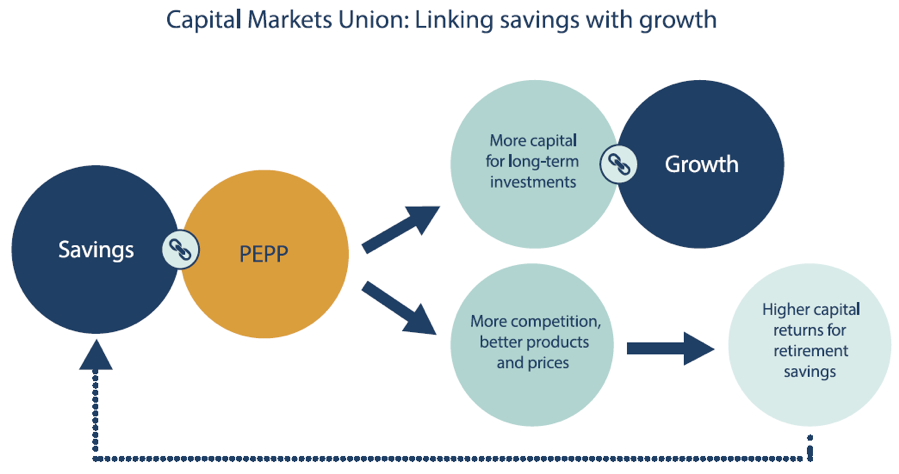

“The pan-European personal pension product is an important milestone towards completing the Capital Markets Union. It has enormous potential as it will offer savers across the EU more choice when putting money aside for retirement. It will drive competition by allowing more providers to offer this product outside their national markets. It will work like a quality label and I am confident that the PEPP will also foster long-term investment in capital markets.”

—

Speech by Ingus Alliks, State Secretary of the Ministry of Welfare, Latvia (in English).

—

Speech by Henrik Husman, CEO of Nasdaq Helsinki (in English).

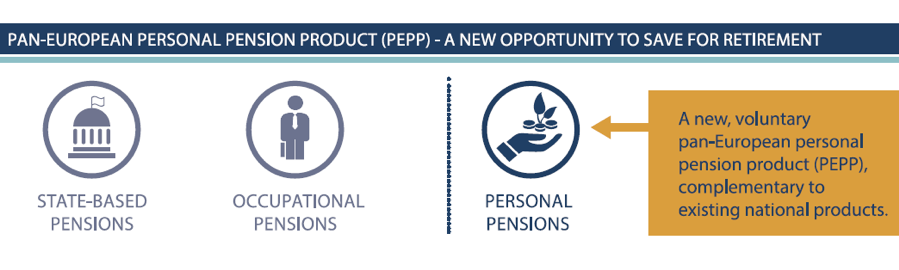

“The pan-European personal pension product as a voluntary scheme will complement existing public and occupational pension systems, alongside existing national private pension schemes, and will therefore address pension gaps and demographic challenges in Europe. We welcome any measures to help consumers to invest in retirement and widen the financial instruments offering available for them in Europe.”

—

After the keynote and all speeches, the panel discussion on such topics as governance of pension products, a mix of products – exchange-traded investment vehicles and alternative investment vehicles, the challenge of enabling adequate yield for pensions products etc. was moderated by Sanda Liepiņa, CEO, Finance Latvia (in English).

The Financial Instruments Market and Investment Services Committee at the Finance Latvia has drafted a working paper to facilitate discussions with partners from the public and private sector, aiming to attract more investment to Latvia and the Baltics: PROPOSALS FOR INCREASING INVESTMENT IN THE BALTICS

On June 2018 Association position on capital market development was approved by the Council.

Background (European Commission – Press release, 29 June 2017)

Background (European Commission – Press release, 29 June 2017)

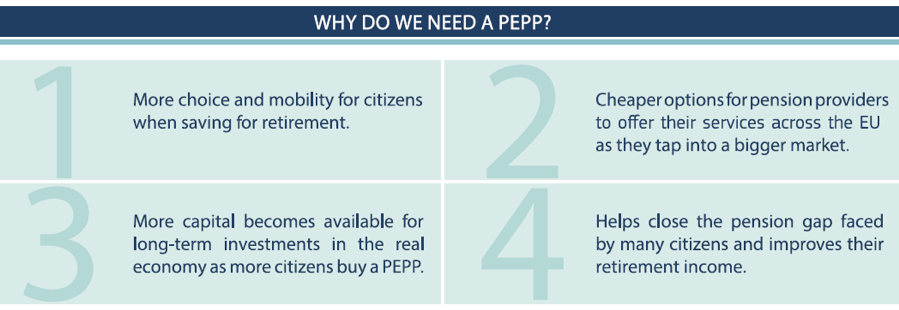

The PEPP is one of the key measures announced in last month’s Mid-term Review of the Capital Market Union, the Commission’s project to create a single market for capital in the EU. The PEPP supports the goal of the CMU, which is to create the right conditions to unlock funding so that it can flow from Europe’s savers to Europe’s businesses.

Currently, only 27% of Europeans between 25 and 59 years old have enrolled themselves in a pension product. PEPP would contribute to unlocking this vast potential and boost investment in our economy.

Today’s proposed Regulation builds on almost 600 contributions to the Commission’s public consultation on personal pensions in October 2016. Many respondents said the current supply of personal pension products in the EU was insufficient. It also took into account two reports from EIOPA in 2014 and 2016 and an external study by an external contractor.

The PEPP proposal will now be discussed by the European Parliament and the Council. Once adopted, the Regulation will enter into force 20 days after its publication in the Official Journal of the European Union.